|

|

|

|

|

||

|

|

|

Platforms To deploy ForeStock on TradeStation, please follow these steps:

Watch imported functions in Easy Language editor. Use provided functions as templates for your own functions and strategies.

Below there is full Easy Language code of Aura Forecast Engine call.

{******************************************************************* Description: Aura Forecast Engine Extended Provided By: Boris Zinchenko (c) Copyright 2008 ********************************************************************}

DefineDLLFunc: "EEOmegaX.dll", float, "AURA_ENGINE_EX", LPSTR, DWORD, DWORD, LPLONG, LPINT, LPLONG, LPLONG, LPLONG, LPLONG, LPLONG, LPLONG, LPSTR, LPSTR, DWORD;

{ Inputs }

Inputs: AlgorithmName(String), InputLength(Numeric), SeriesNames(String), Parameters(String), ForecastLength(Numeric), Forecast(NumericRef);

{ Inner variables } Variables: Dummy(0), Counter(0);

{ Reserve arrays for data } Dummy = Date[InputLength]; Dummy = Time[InputLength]; Dummy = Open[InputLength]; Dummy = High[InputLength]; Dummy = Low[InputLength]; Dummy = Close[InputLength]; Dummy = Volume[InputLength]; Dummy = OpenInt[InputLength];

{ Call solver } Forecast = AURA_ENGINE_EX((LPSTR)AlgorithmName, (DWORD)MaxBarsBack, (DWORD)PriceScale, (LPLONG)&Date, (LPINT)&Time, (LPLONG)&Open, (LPLONG)&High, (LPLONG)&Low, (LPLONG)&Close, (LPLONG)&Volume, (LPLONG)&OpenInt, (LPSTR)SeriesNames, (LPSTR)Parameters, (DWORD)ForecastLength);

AuraEngineExt = Forecast;

Short description of input parameters:

This is very simple example of calling engine in trading strategy.

{******************************************************************* Description: StockFusion Universal Signal Provided By: Boris Zinchenko (c) Copyright 2008 ********************************************************************}

Inputs: AlgorithmName("Linear Regression"), InputLength(500), SeriesNames("Close"), Parameters(""), ForecastLength(1);

Variables: Forecast(0);

Value1 = QB_AuraEngineExt(AlgorithmName, InputLength, SeriesNames, Parameters, ForecastLength, Forecast);

If (Forecast < Close) AND (Close > Close[1]) Then Sell This Bar at Close; If (Forecast > Close) AND (Close < Close[1]) Then Buy This Bar at Close;

Of course, real strategies are typically more complex and realistic . |

Unraveling the Mystery

of Stock Prices

| Boris G. Zinchenko |

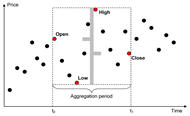

Here’s a simple method you can apply to interpret financial charts. It uses classical statistics as well as a number of simple chart indicators, which may help you better understand classical charts from the viewpoint of random processes.

Every trader is familiar with stock charts. To most traders the chart is just a common tool, like a hammer is to the carpenter. The exception is the new trader reading charts for the first time or the advanced trader who begins to question the value of the charts he or she watches.

Although financial charts can be vivid and attractive, they do tend to have contradictions with modern statistics. The charts can introduce dubious and unstable measures, which in turn become the basis of popular trading strategies. This could increase the risk of your trading operations.

...read further in

Stocks & Commodities V. 28:3 (10-16)

| Download Full featured free trial |

|

| User's guide Step by step tutorial |

|

| Questions? Find immediate answer! |

Trading financial instruments, including foreign exchange on margin, carries a high level of risk and is not suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in financial instruments or foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts. Please view the document titled Risk Disclosure Statement for Futures and Futures Options.