|

|

|

|

|

||

|

|

|

Algorithms Built-in forecasting expert works on unique collection of elaborate predictors, technical indicators, digital filters and statistical tests to achieve top forecasting accuracy and reliability in full automated unattended mode. Not offered in any other product. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trading strategies

Forecasting algorithms

Trading performance criteria

|

Technical indicators

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Free open API enables unlimited system extensibility both in data access and additional forecasting technologies which then are native consumed in system kernel expert reasoning. SOAP, DCOM and C++ bindings give easy direct integration with virtually any enterprise infrastructure including Java, NET, Delphi, MS Office, online portals and interactive web services.

Formulas Below we provide the full table of algorithms available in ForeStock. Algorithms are grouped according to their packages. Packages are separate modules in common algorithmic space and are licensed individually. You can watch names of packages in License Manager. Licensing any package implies all algorithms contained inside it.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Unraveling the Mystery

of Stock Prices

| Boris G. Zinchenko |

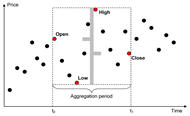

Here’s a simple method you can apply to interpret financial charts. It uses classical statistics as well as a number of simple chart indicators, which may help you better understand classical charts from the viewpoint of random processes.

Every trader is familiar with stock charts. To most traders the chart is just a common tool, like a hammer is to the carpenter. The exception is the new trader reading charts for the first time or the advanced trader who begins to question the value of the charts he or she watches.

Although financial charts can be vivid and attractive, they do tend to have contradictions with modern statistics. The charts can introduce dubious and unstable measures, which in turn become the basis of popular trading strategies. This could increase the risk of your trading operations.

...read further in

Stocks & Commodities V. 28:3 (10-16)

| Download Full featured free trial |

|

| User's guide Step by step tutorial |

|

| Questions? Find immediate answer! |

Trading financial instruments, including foreign exchange on margin, carries a high level of risk and is not suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in financial instruments or foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts. Please view the document titled Risk Disclosure Statement for Futures and Futures Options.